- Best VBScript Interview Questions & Answers

- Flutter vs React Native - What's the Difference?

- Flutter vs Ionic - What's the Difference?

- Windows Server Interview Questions

- Windows Administrator Interview Questions

- Power Automate – Tutorial

- Redis Interview Questions

- TestRail Tutorial

- Rust Tutorial

- Rust Interview Questions

- Workato Interview Questions

- Test Page

- dummy page

QuickBooks is a Financial Management and Accounting Software mainly designed for small and medium-sized businesses. It helps them efficiently manage their financial statements and hence remain in a transparent and clear position. It is a cloud-based software providing online free versions as well as licensed versions.

It was developed and initially introduced in the market by its parent company Intuit in 1983. Since then, it has released several versions with increasing competency in every single release. Financial Management is needed in all the organizations, be it companies, hospitals, or hotels. And the knowledge of QuickBooks is a skill very much in demand among employers. Therefore, there are a plethora of opportunities in this sector from a career perspective.

Let us first have some insights on these interesting facts about QuickBooks:

- QuickBooks' market share is around 80% in the US's small and medium-sized business world. And many new customers are getting added each year.

- Around 83,000 companies are using QuickBooks.

- QuickBooks Online got a rating of 4.2 out of 5 by 3520 users on Capterra.

- According to payscale.com, an Accountant with Intuit QuickBooks skills can earn an average salary of $52,302 per annum.

We will look at the QuickBooks Interview Questions-2024 (updated) for:

Top 10 QuickBooks Interview Question And Answers

QuickBooks Interview Questions for Freshers:

1. What is an accounting equation?

The fundamental accounting equation shows the relationship between the assets, liabilities, and equities. It is also taken as the basis for the double-entry system of bookkeeping. According to it, the assets should always be equal to the sum of the liabilities and the equities.

2. What is displayed in Accountant Reports in QuickBooks?

The following are included in QuickBooks' Accountant Reports:

- Trial Balance

- Cash Flow Statement

- Profit and Loss Statement

- Account Listing

- Transactions detail by account

- Transaction list by date

- Recent automatic transactions

3. Explain the difference between Accrual and Cash Basis.

Under a Cash basis, the financial transactions (including all incomes and expenses) are recorded only when paid. There is no time gap between the transaction and actual payment.

Under an Accrual basis, the financial transactions (such as rent expenses) are recorded regularly, whether paid or not. Therefore all the transactions with the difference in time between the actual payment and the transaction are recorded under it. For example, customer deposit liabilities, prepaid expenses, accounts payable, accounts receivables, etc.

4. What is meant by Sub-account? And what is its use?

A sub-account is a part of the main or the parent account only.

Use- We use sub-accounts when we want to put additional details or create categories within the main document. For example, rent and food are sub-accounts of a monthly expense.

5. What are the two main reports in QuickBooks? What is the difference between them?

The two main reports in QuickBooks:

- The profit and loss statement includes the income, expenses, and net profits (income expenses) for a specific period.

- The balance sheet includes assets, liabilities, and equities on a specific date. Assets are always equal to liabilities plus equities.

Actually, the net profit from the profit and loss statement falls under the equity section of the balance sheet.

6. What are the main account types in the chart of accounts of QuickBooks?

Asset, liability, equity, income, and expense are the 5 many account types used to record transactions.

7. Mention the difference between a customer transaction detail report and a custom summary report.

- A customer transaction detail report contains itemized transactions, that is, line by line and transaction by transaction.

- A customer summary report contains totals for a particular account- for vendors or customers.

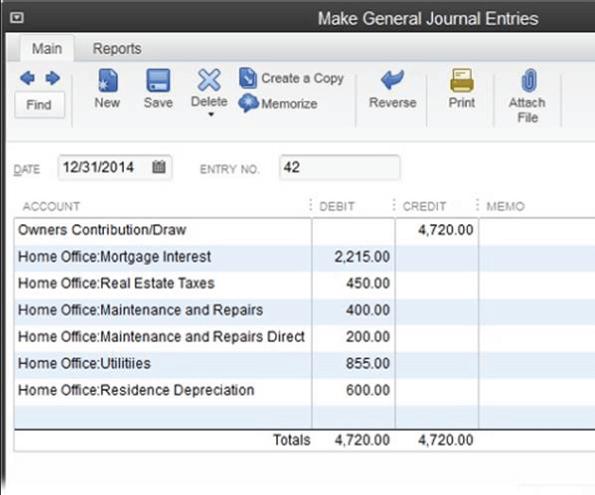

8. Explain step-by-step the process of deleting a journal entry.

To delete a journal entry, the following steps need to be followed:

- Go to the menu> click on the company option> select make a journal.

- Move to the journal that you would like to delete.

- Select the edit option> select delete journal.

9. Explain the differences between accounts and items.

Accounts: These are the categories made up of the transactions recorded under the balance sheet, cash flow statement, and profit and loss statement. For example, capital accounts and inventory accounts.

Items: These are the services that are generally used on transactions like purchase orders.

10. In QuickBooks, is the tax on your income calculated by a self-employed version of QuickBooks?

Yes, the tax on our income is calculated by a self-employed version of QuickBooks.

11. What are the main features of QuickBooks documents?

The main features of QuickBooks documents are as follows:

- Synced with QuickBooks online

- Attorney drafted template

- Securely stored file (stored with SSL encryption)

- E-sign (for legalized document)

12. What is meant by the Un-deposited Funds Account?

When a payment is made by the client, but it is not deposited in the bank account (the one registered in QuickBooks), QuickBooks uses this temporary account.

13. How can the QuickBooks Financial Reports be brought into Excel?

It is one of the most simple and important things because excel allows us to do statistical analysis and manipulate numbers.

For the process, Excel must have been installed on the computer. Now click on the "Excel" button and create a new worksheet.

14. What do you do to repeat a recurring transaction in QuickBooks?

We program it through Memorize Reports (CRT+M)

The transaction will be automatically created in the future by this Automate Transaction Entry.

15. Mention the requirements for analyzing a financial report.

The everyday transactions and processes do not show major developments. But over a long period of time, the data and the transactions get multiplied to large levels. Therefore, to avoid any discrepancy or any undesirable transactions leading to a loss for the company, analysis is required.

QuickBooks Interview Question for Experienced:

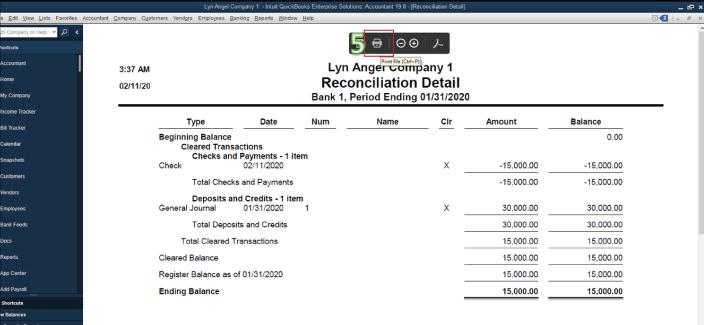

1. What are the reconciliation reports, and what do they include?

- Balance sheet: It specifies the assets, liabilities, and equities.

- Journal: It chronologically displays the categorized transactions into credits and debits.

- Ledger: It displays the total transactions for all the accounts consolidated in a single place. It helps to verify if credits are equal to debits.

- Transaction list with splits: It shows the transactions along with their split lines.

- Scorecard: It is used to compare the company's performance (profitability and sales growth) with that of other companies.

- Recent Transactions: The transactions made within the last 4 days are displayed here.

2. Explain how a QuickBooks server can be set up to host multi-user access.

Follow the given steps to install a multi-user network for the QuickBooks desktop:

- Open the QuickBooks desktop software.

- Click on the File menu

- From the list, select the Multi-user mode.

Follow the given steps to switch between modes:

- Go to the File menu.

- Select the Multi-user mode.

3. Explain the difference between the cost of goods sold and the operating expenses.

The cost of goods sold is related to the sale of products or services, such as the cost of inventory, labour cost, etc. It is mostly the current cost.

Operating expenses are not directly related to the sale of products or services, such as administrative costs, rent, etc.

4. What does it mean by an Advanced QuickBooks User, in your opinion?

Knowledge of the different versions of the QuickBooks, the ability to create custom reports and describe them as well, not letting any discrepancies occur in the reports, and being able to work with multiple QuickBooks files are the qualities.

5. What is meant by having negative inventory? What can be done to Troubleshoot Inventory Issues?

Negative inventory occurs when we sell the inventory that we don't really have.

We can go through the "quick report" of the particular item and check the time of coming in and going out of inventory to Troubleshoot inventory issues.

6. Where do the values "beginning balance" and "ending balance" come from when reconciling a bank account?

"Beginning balance" coming from the bank statement equals the reconciled balance of the last month.

"Ending balance" coming from the bank statement equals the total amount of the cleared transactions.

7. Explain Operational Expense in QuickBooks (OPEX).

OPEX includes short-term operating expenses that occur daily. Expenses like the cost of goods, the selling costs, the marketing costs, and the administration are included in OPEX. This helps in analyzing the transactions daily to plan accordingly.

8. Explain Capital Expense in QuickBooks (CPEX).

CPEX includes the long-term financial and investment expenses that help to grow in the future. The loans and the collateral come under the CPEX category. This is used to devise long-term plans.

9. Why is bank reconciliation considered necessary?

Bank reconciliation means the consistency between the company's record and the bank's record. Therefore it is necessary to avoid any future problems in the company's statements and records.

10. What are the two types of budget reports in QuickBooks?

- Budget Overview: This is the report that presents a summary of budgeted amounts for a specific period.

- Budget vs Actuals: This is the report that presents a summary of budgeted accounts versus actual amounts, along with their variances and variance percentages.

11. Explain the payroll feature of QuickBooks.

Payroll is an easy-to-use option available where employees are provided with a self-service portal to download payslips, change any details, and also apply for leave.

12. Explain how the QuickBooks Self-Employed account can be secured.

The following need to be taken care of to secure a self-employed account:

- Not sharing QuickBooks password with anyone.

- Have a strong password.

- Ensuring the presence of a firewall in the computer.

- Not installing any programs from unknown sources.

13. How can QuickBooks be helpful in managing products and inventory?

QuickBooks can be helpful in managing products and inventory because of the following features:

- Inventory valuation detail

- Inventory valuation summary

- Purchases by-product or service detail

- Sales by product or service detail

- Sales by product or service summary

14. Mention the steps of accepting a customer's payment and recording it in the bank.

The given steps need to be followed to accept and record a customer's payment in the bank:

- Click on Receive Payments> select the client and invoice

- Click on the Record Deposits > record all the payments needed to be recorded.

15. Why is a sales order used instead of an Invoice?

The invoice is the statement of the finalized sales that have been completed. Whereas a sales order records an approved sale by the client but for which the inventory has not been yet affected. A sales order can lead you to a position called "backorder", where you can sell something you don't have. But the inventory has been committed to that customer instead of showing it as "available for sale".

Top 10 Frequently Asked Interview Questions on QuickBooks:

1. Mention some uses of QuickBooks.

Accounting, tax filling, inventory, invoicing, payroll, payment processing, budgeting, expense management, account payables, and account receivables- are some of the tasks that can be performed using QuickBooks.

2. List the versions available in QuickBooks.

The following versions are provided by QuickBooks:

- QuickBooks Online

- QuickBooks Self-employee

- QuickBooks Enterprise

- QuickBooks Premier

- QuickBooks Pro

3. What are the benefits of using QuickBooks?

QuickBooks is beneficial because:

- It provides customer-oriented, easy-to-use software.

- It provides industry-specific solutions.

- It can seamlessly integrate with other systems such as CRM software.

- It has a large data capacity.

- It is always up-to-date with the latest technologies.

- It keeps financial data secure because of a great automated backup service.

4. Mention some companies which use QuickBooks.

MWW Group LLC, Lewis Inc., Zimmerman Advertising LLC, Federal Emergency Management Agency, and Zendesk Inc. are some of the companies which use QuickBooks.

5. List some competitors of QuickBooks.

- Xero

- FreshBooks

- Wave

- Sage Intact

- Tally

- Infor

- Sage 50cloud

- NetSuite

6. What are the four main types of QuickBooks transactions?

In QuickBooks, transactions can be categorized into four types- Customer and Sales, Banking, Employees and Payroll, and Banking.

7. Can multiple companies be set up under one QuickBooks account?

Yes, as many companies as desired can be set up under a single QuickBooks account. When signing up for the first time for QuickBooks, you will have a QuickBooks account created. Multiple companies can be set up under that same account using those credentials.

8. What do you mean by QuickBooks Hosting or QuickBooks Clouding?

QuickBooks clouding means installing the original desktop software on remotely located, third-party servers (web server of the company). It is ensured that the data servers that house these servers are situated in a safe place and not in a disaster-prone area.

9. Can a credit card account be added to QuickBooks feeds?

Yes, QuickBooks allows and facilitates the addition of as many credit cards and bank accounts as desired by the user. This is regardless of the subscription plan chosen.

10. Mention the benefits of hosting QuickBooks on the cloud.

QuickBooks on the cloud is always preferred because of the following reasons:

- It is pocket-friendly

- It enhances data security

- The data stored on the software is accessible anywhere and anytime

- It facilitates collaboration by many users in real-time

- It enables work on-the-go

- It provides more flexibility and scalability

Conclusion

The Financial Management sector and the skills associated with it, such as QuickBooks, are on the rise these days and so do its future prospects. When you have already done a lot, why leave the slightest possible chance of rejection by not preparing beforehand. Therefore, we are glad to see you here, preparing so diligently for your interview. Hoping that you have gone through the above-mentioned questions properly, we are bidding adieu along with leaving best wishes for you.

On-Job Support Service

On-Job Support Service

Online Work Support for your on-job roles.

Our work-support plans provide precise options as per your project tasks. Whether you are a newbie or an experienced professional seeking assistance in completing project tasks, we are here with the following plans to meet your custom needs:

- Pay Per Hour

- Pay Per Week

- Monthly

| Name | Dates | |

|---|---|---|

| Oracle Project Accounting Training | Feb 28 to Mar 15 | View Details |

| Oracle Project Accounting Training | Mar 03 to Mar 18 | View Details |

| Oracle Project Accounting Training | Mar 07 to Mar 22 | View Details |

| Oracle Project Accounting Training | Mar 10 to Mar 25 | View Details |