- SAP Interview Questions

- SAP MDG Interview Questions

- SAP PS Interview Questions

- SAP C4C Interview Questions

- SAP ISU Interview Questions

- SAP Analytics Cloud Interview Questions

- SAP CO Interview Questions

- SAP CPI Interview Questions

- SAP VIM Interview Questions

- SAP SCM Interview Questions

- SAP IBP Interview Questions

- SAP TM Interview Questions

- SAP CPI Architecture

- What is SAP Transportation Management ?

- What is SAP SCM?

- What is SAP PO - SAP Process Orchestration Architecture

- SAP PO Interview Questions

- What is SAP EDI?

- What is SAP Vistex?

- What is SAP Cloud Platform?

- What is SAP MRP - SAP MRP Tutorial

- What is SAP BTP?

- What is SAP Fieldglass?

- What is SAP C4C?

- What is SAP ISU

- What is SAP Solution Manager?

- SAP Analytics Cloud Tutorial

- SAP HCM Interview Questions

- What is SAP APO?

- SAP CPI Tutorial - A Beginner’s Guide

- What is SAP CAR?

- What is SAP PS - SAP PS Tutorial

- What is SAP IBP?

- What is SAP CPQ

- What Is Sap Netweaver

- What Is SAP BRIM

- What is SAP Master Data Governance (MDG)?

- What is SAP VIM?

- SAP MDG Architecture

- What is SAP MDG

- SAP HCM Tutorial

- SAP MDG Tutorial

- SAP TRM Interview Questions

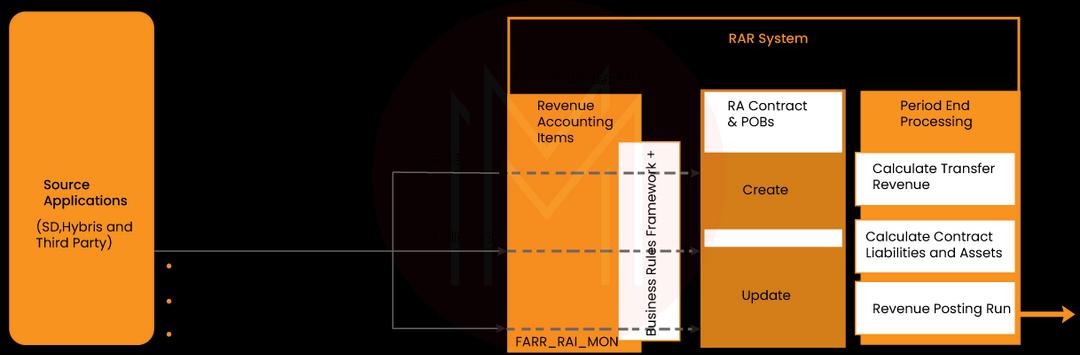

SAP RAR (Revenue Accounting and Reporting) is a highly sophisticated module within the SAP ERP system that offers advanced tools for managing complex revenue recognition processes in compliance with accounting standards. It provides a centralized platform that streamlines RAR processes, automating and standardizing them to improve accuracy and efficiency while reducing errors and mitigating financial risks.

By leveraging the capabilities of SAP RAR, organizations can gain a comprehensive view of their revenue recognition activities, ensuring compliance with regulatory requirements and enhancing financial performance. To prepare for an SAP RAR interview, candidates should review their knowledge of accounting standards and principles and their experience using SAP RAR in a professional context.

At Mindmajix, we provide a comprehensive range of topics that can help candidates prepare for their interviews. Our resources can aid in gaining a deeper understanding of the module, increasing the chances of cracking the interview and advancing one's career in this field.

Additionally, to provide detailed interview questions, we have divided them into two sections

Top 10 Frequently Asked SAP RAR Interview Questions

- What is a contract in SAP RAR?

- What are the key benefits of using SAP RAR for revenue recognition?

- What do you mean by accounting document type?

- What is the accounting entry when you do PGI?

- How does SAP RAR integrate with SAP FI and SAP CO?

- How do revenue G/L accounts set up in the standard system?

- What is a revenue element in RAR?

- What key reports and analytics are available in SAP RAR?

- Where are RAR files used?

- What are the different types of SAP reports?

SAP RAR Interview Questions For Freshers

1. What is SAP RAR?

SAP RAR, short for SAP Revenue Accounting and Reporting, is a module in SAP S/4HANA designed to assist businesses in adhering to revenue recognition guidelines set forth by the IASB and FASB.

2. How does SAP RAR help in revenue recognition?

SAP RAR assists businesses in recognizing revenue by offering a comprehensive framework for revenue recognition, comprising multiple revenue recognition methods and a flexible accounting engine that automates the recognition process.

| If you want to enrich your career and become a professional in SAP RAR, then enroll in "SAP RAR Training" - This course will help you to achieve excellence in this domain. |

3. What is the significance of revenue recognition in financial reporting?

Revenue recognition is important for financial reporting because it affects the top line of a company's financial records. It is important to make sure that income is recorded according to the rules for accounting.

4. What are the different revenue recognition methods in SAP RAR?

SAP RAR supports multiple revenue recognition methods, including

- Percentage of completion

- Subscription-based

- Point in time (PIP)

- Over time (OOT)

- Percentage of completion (POC)

- Milestone

- Time and material (T&M)

- Subscription

5. What is a contract in SAP RAR?

In SAP RAR, a "contract" is a binding deal between a business and a customer that spells out the terms and conditions of a transaction. There can be more than one performance obligation in a contract. These are the goods or services a business has promised its customers.

6. How does SAP RAR handle multiple performance obligations?

SAP RAR handles multiple performance obligations by applying the appropriate revenue recognition method to each performance obligation based on the contract terms.

7. What is the role of the performance obligation identifier in SAP RAR?

The performance obligation identifier is a unique identifier assigned to each performance obligation in a contract. It is used to track and manage revenue recognition for each performance obligation separately.

8. How does SAP RAR handle variable consideration?

SAP RAR handles variable consideration by estimating the amount of consideration that a business is expected to receive and recognizing revenue based on that estimate.

9. What are some key benefits of using SAP RAR for revenue recognition?

Using SAP RAR for revenue recognition provides several key benefits, including

- Providing a centralized source of revenue data for the entire organization

- Automating and streamlining the revenue recognition process to reduce errors and increase productivity

- Assisting with the implementation of revenue recognition standards such as ASC 606 and IFRS 15

- Enabling real-time visibility into revenue data and the creation of customizable reports and analytics

- Offering flexibility to support different revenue recognition methods and scenarios

- Integrating with other SAP modules to provide a unified view of business processes.

10. What is an accounting entry when you create a proforma invoice?

When a proforma invoice is created, no accounting entry is recorded since it is not an official request for payment. It is only a document that specifies the details of the goods or services, such as the price and sales conditions. The accounting entry is made only when the actual invoice is created and sent to the customer.

11. What is an accounting entry when you create a cash sale?

This transaction is recorded using a double-entry system to ensure the completeness and accuracy of the financial records. When a sale is made for cash, two accounts are involved in the accounting entry - the cash and sales revenue accounts. The cash account is credited as cash is received, while the sales revenue account is debited to record the revenue earned from the sale. The resulting entries reflect an increase in cash balance and sales revenue.

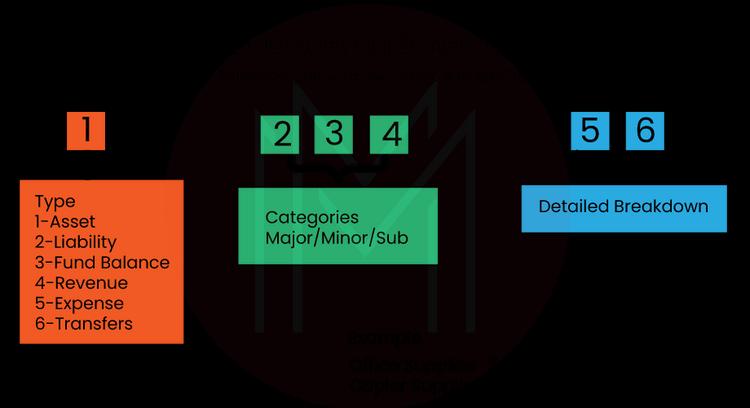

12. What do you mean by accounting document type?

In SAP software, an accounting document type is a two-character code that identifies different financial accounting documents. It categorizes these documents based on their business transactions and characteristics. The document type plays a crucial role in determining the accounting document's account posting rules, number range, and other attributes. It helps maintain consistency and accuracy in accounting practices by controlling the creation and posting of accounting documents. Some examples of accounting document types in SAP are vendor invoices, customer payments, purchase orders, and general journal entries.

13. How do systems understand whether to pick KOFI or KOFK?

When users create a financial document, they must enter a document type, which determines the accounting document's account posting rules, number range, and other attributes. In SAP, two different posting keys, KOFI and KOFK, are used for posting vendor invoices and vendor credit memos, respectively. The system determines which document type to use based on the transaction being performed. Based on the document type entered, the system understands which posting key to use for the vendor account and which account to credit or debit. This helps to ensure that the financial documents are accurately posted to the appropriate accounts according to the organization's accounting policies and procedures.

14. What documents does the system generate when you create an invoice?

When you create an invoice in a system, several documents are generated automatically. These include:

- Sales invoice

- Accounts receivable record

- General ledger entry

- Inventory record

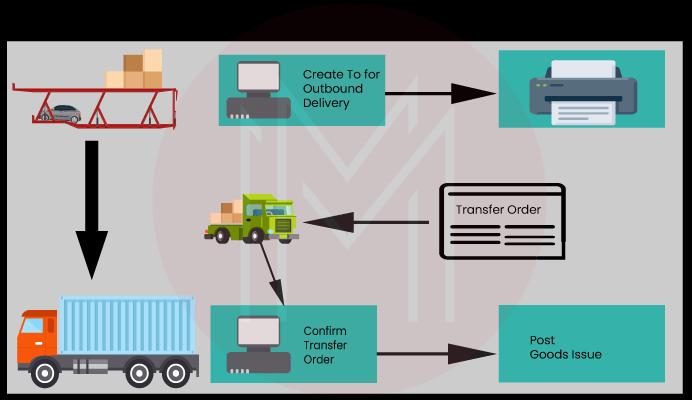

15. What is the accounting entry when you do PGI?

The accounting entry for PGI (Post Goods Issue) involves debiting the Cost of the Goods Sold account and crediting the Inventory account. This reflects the cost of the goods that have been sold and the decrease in the number of goods in stock. The Cost of Goods Sold account reflects the expense incurred by the company for producing or purchasing the goods, while the Inventory account shows the quantity and value of the goods held by the company. The company can accurately maintain an up-to-date inventory record by making this accounting entry.

SAP RAR Interview Questions For Experienced

16. How does SAP RAR manage revenue recognition for contracts with multiple performance obligations?

SAP RAR can distribute revenue to multiple performance obligations based on their fair value. The allocation is usually based on standalone selling prices, but observable transaction prices can be used instead if those are not available. It's important to understand the nature and timing of the performance obligations, make sure the allocation method works with the overall contract, and keep track of progress toward fulfilling each obligation.

17. How does SAP RAR integrate with SAP FI and SAP CO?

SAP RAR collaborates with other SAP modules, such as SAP FI and SAP CO, to ensure accurate recording and reporting of revenue recognition activities. Integrating with SAP FI involves posting revenue recognition entries to the general ledger, while integration with SAP CO involves tracking revenue and cost data for each performance obligation. Sharing contract data, such as billing and payment terms, among different modules also ensures consistency in methods.

| Related Article - SAP CO Interview Questions |

18. What is the difference between SAP RAR and SAP SD?

SAP RAR is concerned with revenue recognition and compliance with the new revenue recognition guidelines. In contrast, SAP SD (Sales and Distribution) is concerned with the sales process, which includes order administration, pricing, and delivery.

19. What do businesses face some common revenue recognition challenges?

Some common revenue recognition challenges include

- Identifying performance obligations

- Estimating variable consideration

- Allocating revenue

- Handling contract modifications.

SAP RAR provides a comprehensive framework for revenue recognition that helps businesses address these challenges and comply with the new revenue recognition guidelines.

20. How does SAP RAR handle multi-currency transactions, and what considerations should businesses consider when dealing with multi-currency contracts?

Establishing clear exchange rate policies and consistently adhering to them is important. SAP RAR allows enterprises to record revenue in their preferred currency and supports several currencies. However, firms should avoid exchange rate fluctuations, which can affect revenue recognition and financial reporting.

21. How does SAP RAR handle revenue recognition for long-term construction projects?

SAP RAR enables businesses to use the percentage of completion method to recognize revenue throughout long-term building projects. These projects require careful tracking of costs and progress and consideration of potential contract changes or delays.

22. What is the T code to manually post invoice values into accounting?

The "FB50" transaction code is used in SAP to manually post invoice values to accounting. This allows users to enter financial postings directly into the system, including information such as document type, posting date, account code, debit/credit amounts, and other relevant data. Once entered, the system will generate an accounting document and post the corresponding entries to the appropriate general ledger accounts. FB50 is usually used for journal entries, adjustments, and other financial transactions that automated systems cannot process.

23. How do revenue G/L accounts set up in the standard system?

In the standard configuration, the revenue G/L (General Ledger) accounts are determined by the sales organization, distribution route, and product hierarchy in SAP. The system uses this combination of factors to identify the appropriate revenue account to post the sales revenue based on the organization's business policies and rules. This process is called "account determination," and it is a crucial function of the SAP Sales and Distribution (SD) tool.

24. Differentiate Master data, Metadata, and Transaction data?

| Term | Definition | Examples |

| Metadata | Data that provides information about other data. It helps in managing and understanding data in the system. | Data structures, data types, data relationships, and data lineage. |

| Master Data | Core data entities that are used to represent key business objects. It is the key data used in the transactional processes. | Customers, products, vendors, employees, chart of accounts. |

| Transaction Data | Data is generated as a result of the business transactions that occur in the system. It is used for record-keeping and reporting purposes. | Sales orders, purchase orders, invoices, payments, receipts. |

25. How can SAP RAR streamline an organization's revenue accounting and reporting processes?

SAP RAR can help organizations streamline their revenue accounting and reporting processes in several ways

- Centralized revenue management

- Automation of revenue accounting

- Real-time revenue reporting

- Compliance with revenue recognition standards

- Improved collaboration between teams

26. What is a revenue element in RAR?

Revenue elements play a critical role in precise revenue recognition and reporting in compliance with accounting standards such as IFRS 15 and ASC 606. A revenue element in SAP RAR refers to an organization's revenue from a product or service. It categorizes revenue streams according to their nature and is linked to specific revenue recognition guidelines.

27. What is the difference between Contract Modification and Contract Extension in RAR?

Here are the differences between Contract Modification and Contract Extension in SAP RAR in tabular format

| Parameter | Contract Modification | Contract Extension |

| Definition | A change in the terms of an existing contract | The continuation of an existing contract beyond its original end date |

| Timing | Can occur at any point during the contract term | Occurs at the end of the original contract term |

| Accounting Treatment | May result in a change in revenue recognition, depending on the nature of the modification and the applicable accounting standards | Does not typically result in a change in revenue recognition |

| Impact on Performance Obligations | May result in the addition, removal, or modification of performance obligations | Typically does not impact existing performance obligations |

| Process in RAR | Involves the creation of a new contract version in RAR and the reevaluation of revenue recognition based on the new terms | Involves the extension of the existing contract in RAR, typically with no changes to revenue recognition |

| Examples | Changing the quantity of goods or services to be delivered, changing the price of goods or services, changing the delivery date | Extending a support contract for a software product, extending a service contract for a piece of equipment |

28. How can you configure SAP RAR to recognize revenue at a point in time or over time?

You can use the revenue recognition rules feature to configure SAP RAR (Revenue Accounting and Reporting) to recognize revenue at a point in time or over time. This feature allows you to set up specific rules for different types of contracts and products or services.

For recognizing revenue over time, you can configure revenue recognition based on a percentage of completion or time and materials. It involves setting up performance obligations and linking them to specific revenue elements to ensure accurate revenue recognition over the duration of the contract.

You can configure revenue recognition based on delivery or acceptance to recognize revenue at a point in time. This involves setting up the relevant criteria for delivery or acceptance and linking them to specific revenue elements to ensure accurate revenue recognition at the appropriate point in time.

Overall, configuring SAP RAR to recognize revenue at a point in time or over time involves careful consideration of the relevant criteria and linking them to the appropriate revenue elements.

29. What key reports and analytics are available in SAP RAR?

Some key reports that are available in SAP RAR are revenue recognition analysis report, revenue analytics dashboard, revenue forecast report, and contract profitability analysis

30. How exactly does SAP RAR help compliance with ASC 606 and IFRS 15 for the recognition of revenue?

You can assure compliance with the law by configuring the system to use SAP RAR in a manner that adheres to the specific standards outlined in statutes such as IFRS 15 and ASC 606. In order to achieve this goal, performance responsibilities will need to be connected with specific revenue elements, and rules for revenue recognition will need to be created based on the applicable criteria, such as delivery, acceptance, or the proportion of work that has been completed. In addition, compliance tests and validations are a part of SAP RAR. These features were added to ensure that the method by which income is acknowledged is accurate and in line with applicable regulations.

SAP RAR Interview Preparation Tips

Here are some tips for preparing for an SAP Revenue Accounting and Reporting Interview

- Learn the basics of accounting for revenue and how it impacts financial reports and compliance.

- Review SAP RAR's main features and functions, such as income recognition rules, contract management, and reporting and analytics.

- Be ready to discuss your experience configuring and implementing SAP RAR and any problems or issues you have encountered.

- Familiarize yourself with important financial rules and standards, such as ASC 606 and IFRS 15, and understand how SAP RAR can ensure compliance with them.

- Demonstrate your ability to think critically and solve problems and your collaboration skills when working with team members and clients.

- Practice answering common interview questions about revenue accounting and SAP RAR, such as how to set up the system for a specific contract or product/service or how to handle a revenue recognition issue.

- Finally, show enthusiasm for your experience and skills, and demonstrate that you are eager to learn and adapt to new opportunities and challenges.

Most Commonly Asked SAP RAR FAQs

1. What purpose does RAR use in SAP?

SAP's Revenue Accounting and Reporting (RAR) is a useful tool for streamlining and automating the revenue accounting procedures of businesses.

2. What is the full form of RAR in billing?

Revenue Accounting and Reporting is the full form of RAR in billing.

3. What do you mean by SAP revenue recognition?

Using the SAP system, revenue recognition is the process of recording and reporting sales based on accounting rules like ASC 606 and IFRS 15.

4. Where are RAR files used?

To save space and facilitate information sharing, RAR files are frequently used for archiving and compressing data.

5. What is SAP RAR (revenue accounting and reporting)?

SAP RAR is a software tool that helps organizations follow accounting rules and regulations by automating and streamlining the accounting and reporting of revenue.

6. What are the different types of SAP reports?

Different types of SAP reports include

- Financial statements

- Operational reports

- Analytical reports.

7. Can you open a RAR file without the software?

No, RAR files cannot be opened without specific software that can decompress and extract their contents, such as WinRAR or 7-Zip.

8. What is a record-to-report process in SAP?

The record-to-report process in SAP involves recording financial transactions and the generation of financial reports, typically using the SAP General Ledger (G/L) module.

Explore SAP RAR Sample Resumes! Download & Edit, Get Noticed by Top Employers!

Conclusion

In conclusion, the SAP RAR interview questions and answers mentioned above can be very useful for individuals preparing for an interview in this field. These questions provide a better understanding of the concepts and requirements of SAP RAR and practical advice on configuring and using the software effectively. By studying and practicing these questions, candidates can increase their chances of success in their next interview and potentially land their dream job in the SAP RAR career field. Therefore, it is recommended to thoroughly prepare and practice these questions to excel in the interview and stand out from the competition.

Enroll in SAP RAR Training Course to learn more about RAR modules and functionalities.

On-Job Support Service

On-Job Support Service

Online Work Support for your on-job roles.

Our work-support plans provide precise options as per your project tasks. Whether you are a newbie or an experienced professional seeking assistance in completing project tasks, we are here with the following plans to meet your custom needs:

- Pay Per Hour

- Pay Per Week

- Monthly

| Name | Dates | |

|---|---|---|

| SAP RAR Training | Mar 07 to Mar 22 | View Details |

| SAP RAR Training | Mar 10 to Mar 25 | View Details |

| SAP RAR Training | Mar 14 to Mar 29 | View Details |

| SAP RAR Training | Mar 17 to Apr 01 | View Details |

Madhuri is a Senior Content Creator at MindMajix. She has written about a range of different topics on various technologies, which include, Splunk, Tensorflow, Selenium, and CEH. She spends most of her time researching on technology, and startups. Connect with her via LinkedIn and Twitter .